Payment Process

In case Stamp duty is applicable on the form and is to be paid electronically through MCA21 system the following is the process to be followed –

- Upload the Form (Form1, Form5 and Form 44).

- The Stake holder will be able to view both the MCA21 Service and Stamp duty fee.

- Stakeholder can make payment of Stamp duty either by offline mode (Challan) or online mode (Credit card/Net banking).

- For offline mode of payment the challan for electronic Stamp duty will be generated as a separate page in the same file (PDF) as the MCA21 service fee challan.

- For online mode of payment the MCA21 service fee has to be paid first and then the system will redirect the stakeholder to pay Stamp duty fee. If the stakeholder wishes to proceed to pay the Stamp duty he/she has to select ”Stamp duty payment” option.

Once the stake holder selects ”Stamp duty payment”,option he/she would be directed to the payment option screen. He/She can either make the payment offline (Challan) or online mode (Credit card/Net banking). The SRN generated for Stamp duty will be affixed with “D” e.g. D00007443.

- If the stakeholder does not wish to proceed with the Stamp duty payment at this stage, he/she can view the receipt of MCA21 service fee and pay Stamp duty later as explained below.

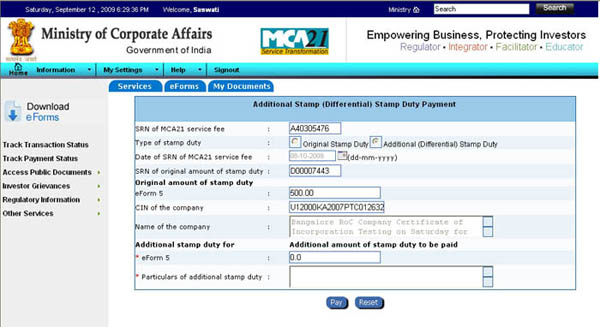

- The stakeholder can pay the Stamp duty by clicking on the “Pay stamp duty fee” option available under the Services menu as shown below. Stake holder can pay the Stamp duty through this link only if the service fee payment has been confirmed. Further the stakeholder would be required to provide the SRN of the service fee (“B” series SRN) before proceeding for payment of stamp duty fee.

| Pay Stamp duty (Click to view enlarge) |

||

|

||

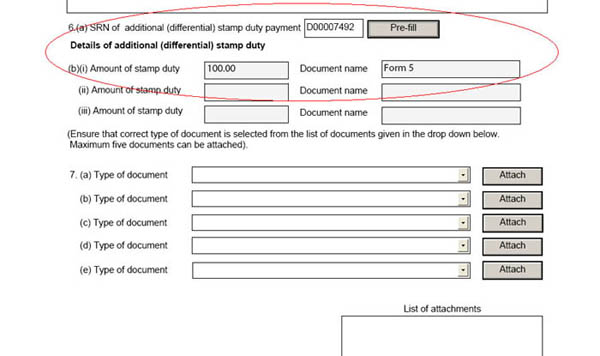

- If the stakeholder is required to pay additional Stamp duty fee, he/she can select “Pay stamp duty fee” option and provide the SRN of the service fee (“B” series SRN) and then proceed to make the payment. The additional (differential) Stamp duty button will be enabled automatically on the Stamp duty payment screen. The Stakeholder has to enter the additional Stamp duty amount & particulars of additional Stamp duty. Stakeholder will need to pay additional Stamp duty in cases where the Form has been put in “Pending for User Clarification”,”Resubmission” with message like “Insufficient Stamp duty Paid. Pay additional amount of…”.

In case the Form has been marked “Pending for User Clarification”, the stakeholder needs to pay the additional Stamp duty and Upload Form 67 with evidence of the Payment as an attachment in the Form 67.

| Additional Stamp duty and Form 67 (Click to view enlarge) |

||

|

|

|

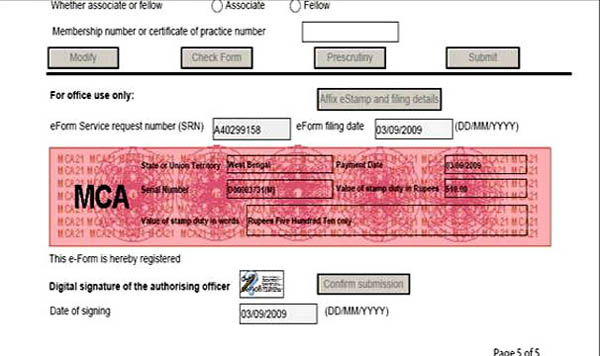

- Once the form has been approved by the Ministry office, Stamp impression will be embossed on the form as shown below.

| Stamp impression on Form (Click to view enlarge) |

|

Important Notes: Validity date of the Stamp duty challan is same as the validity date of the MCA21 service fee challan.

e.g. If the validity of the MCA21 Service Fee challan is 20/09/2009 (7 days from date of filing) then the Validity Date of the Stamp duty challan shall also be 20/09/2009 irrespective of the date of generation of the eStamp challan.

- The form once uploaded will not be submitted for processing till the payment of both the MCA21 service fee (“B” series SRN) and the Stamp duty fee (“D” series SRN) is confirmed in system. In the above case the status of MCA21 service fee will be “waiting for Stamp duty payment” as will be shown in “ Track Transaction Status”.

- If the stakeholder pays the MCA21 Service Fee, but does not pay the Stamp duty fee the status of the Stamp duty shall be displayed as “Expired” and status of the MCA21 Service fee SRN shall be displayed as “Transaction Cancelled – Payment Not Received”.